This system is a legal racket that holds too much power over people’s lives.

By Matthew A. McIntosh

Public Historian

Brewminate

Introduction

The concept of a credit score, which is a numerical expression based on an analysis of a person’s credit files to represent their creditworthiness, has become an integral part of financial systems in many countries, especially in the United States. Ostensibly, credit scores are useful tools for lenders to evaluate the risk of lending money to consumers. However, a closer examination of how credit scores are calculated and used suggests that they may not merely be neutral, objective indicators of financial reliability. Instead, they often function in ways that disadvantage consumers, benefiting financial institutions, and perpetuating socio-economic disparities, leading some critics to describe them as a “racket.”

Opaque Calculation Methods

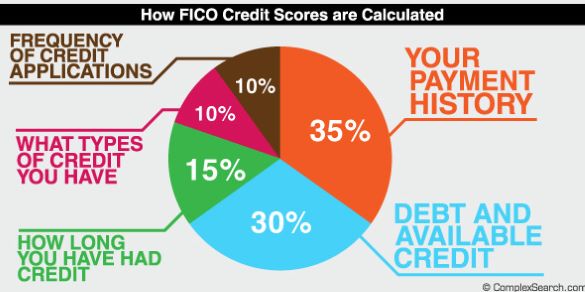

One of the primary critiques of the credit scoring system is the opacity of the scoring process. Credit scores are primarily influenced by factors such as payment history, amounts owed, length of credit history, new credit, and types of credit used. However, the exact algorithms used by major credit bureaus—Equifax, Experian, and TransUnion—are proprietary and not transparent. Although general criteria are known, the specific algorithms used by FICO, VantageScore, and others are proprietary. This lack of complete transparency can make it hard for consumers to understand precisely how to improve their scores. This secrecy not only prevents consumers from fully understanding what affects their scores but also makes it nearly impossible for them to verify whether their scores are calculated correctly.

Bias, errors, and accessibility are also enormous issues. Credit scoring models favor certain groups over others, potentially reflecting systemic biases in financial systems. Credit scores can be significantly affected by errors in credit reports. It’s estimated that a notable percentage of credit reports contain errors, and these can negatively impact scores if not corrected. Not everyone is ‘scoreable,’ particularly those with limited credit history (often young people, immigrants, or those who avoid using traditional credit products), which can exclude them from access to credit.

Disproportionate Impact on the Economically Vulnerable

Credit scores can disproportionately impact low-income and minority groups. People in lower socio-economic strata are more likely to have lower credit scores due to a variety of factors, including reduced access to credit-building opportunities and greater financial instability, which can lead to late payments or higher credit utilization ratios. This system creates a vicious cycle: a low credit score makes it more difficult and expensive to obtain credit, which in turn makes it harder for individuals from these groups to improve their financial stability and credit scores.

Economically vulnerable people are often subject to higher interest rates and less favorable loan terms, which can lead to cycles of debt that are difficult to escape. Payday loans and high-interest credit cards are particularly problematic. If they fail to meet repayment terms, their credit scores can be severely impacted, which can exacerbate their financial difficulties and limit their access to future credit. Vulnerable populations are more likely to be targeted by predatory lenders who offer loans with very high interest rates and onerous terms. This can lead to a situation where the debt grows faster than it can realistically be repaid. Dependence on credit for daily living expenses can lead to a precarious financial situation where individuals are using new credit to pay off existing debts, leading to a potentially unsustainable financial situation. =

High Stakes Based on a Single Metric

The reliance on a single numerical score to make significant decisions about individuals’ financial lives is another point of contention. Credit scores affect the ability to obtain loans, housing, and sometimes employment, with lower scores often leading to higher interest rates, less favorable terms, or outright denial of services. This high-stakes environment based on a potentially flawed and certainly opaque metric seems unjust, particularly when minor discrepancies or errors—which are not uncommon in credit reports—can have major consequences.

Commercial Exploitation

The commercial exploitation of credit scores by credit bureaus and other entities is another aspect that can be seen as making the system a racket. Consumers often have to pay to access their credit scores or to monitor their credit reports to prevent identity theft and errors. Additionally, the credit scoring industry sells consumer data to marketers and other third parties, leveraging personal financial behavior for profit. This commercial aspect raises questions about the primary motivations of maintaining such a system—consumer protection or profit generation.

Predatory lenders impose unfair or abusive loan terms on borrowers. This can include exorbitant interest rates, high fees, and loan terms that make it difficult for the borrower to repay the loan, thus trapping them in a cycle of debt. Credit products may come with complex terms and hidden fees that are not clearly disclosed at the time of signing up. This can include late fees, over-limit fees, and costs for additional services that the consumer may not be aware they have agreed to. Credit card exploitation involves practices like hiking interest rates after the initial promotional period without clear communication, or applying payments in ways that maximize interest charges, among other potentially deceptive practices. Subprime credit offers target individuals with poor credit histories with high-interest credit offers. These offers often come with steep processing fees, high annual fees, and very high-interest rates, further deteriorating the borrower’s financial situation.

Alternative Systems and Solutions

Criticism of credit scores has spurred discussions about alternative methods of assessing creditworthiness. These include looking at regular payments of non-credit bills like rent, utilities, and phone bills—transactions that show financial responsibility but are not currently reflected in traditional credit scores. Some advocates also call for more regulation and greater transparency in the credit scoring process, as well as the development of non-profit credit reporting agencies that could potentially offer fairer, more consumer-oriented services.

Conclusion

While the idea of a system to evaluate financial trustworthiness is not without merit, the current credit scoring system has significant flaws that often make it operate more like a racket than a fair and equitable tool. It privileges certain groups, lacks transparency, exploits consumers for profit, and holds too much power over people’s lives. Reforming this system would involve making it more transparent, inclusive, and less dependent on obscure algorithms that consumers cannot understand or challenge. In doing so, we could move towards a more equitable financial system that truly serves the interests of all consumers.

Originally published by Brewminate, 04.14.2024 under the terms of a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International license.