Trump has taken steps to severely weaken the agency and dismantle consumer guardrails.

By Sachin Shiva

Research Associate

The Center for American Progress

By Lilith Fellowes-Granda

Economic Policy Adviser, Financial Regulation

U.S. Senate Committee on Banking, Housing, and Urban Affairs

Introduction

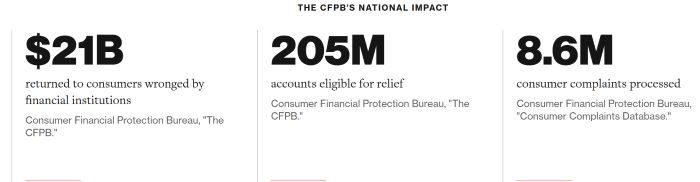

Most Americans cannot afford to lose money to corporations that cheat them or to banks and credit card companies that charge excessive fees. They need somewhere to turn to for help. Since the Consumer Financial Protection Bureau (CFPB) opened its doors in 2011, it has been a formidable advocate for everyday Americans, returning more than $21 billion to consumers harmed by bad actors and implementing countless rules that protect consumers in the financial marketplace, such as a rule to subject overdraft fees to disclosures and protections required for consumer credit, a rule to ban excessive credit card late fees, and a rule to remove medical debt from credit reports.

Unfortunately, the Trump administration recently has taken steps to severely weaken the agency as part of a plan to dismantle consumer guardrails. These actions will green-light predatory practices of big banks and other corporations and place Americans’ financial security at risk.

The CFPB Has Processed Millions of Complaints Worth Billions of Dollars

A core responsibility of the CFPB is to help people when they encounter a problem with a financial institution, product, or transaction. Customers can submit complaints to the CFPB, and the agency then works on their behalf to contact financial institutions and businesses to get answers. Historically, 98 percent of the complaints that the agency has forwarded to companies have received “timely responses.” Since its inception, the CFPB has processed nearly 9 million consumer complaints. Nearly 400,000 of these complaints were submitted by U.S. service members, and close to 200,000 were submitted by older Americans.

enter for American Progress analysis found that the following are the top 5 issues that Americans have sought help with nationwide:*

- Incorrect information on a consumer’s credit report: 3,059,286

- Improper use of a consumer’s credit or other personal report: 1,604,325

- Problem with a company’s investigation into an existing problem: 767,384

- Problem with a credit reporting company’s investigation into an existing problem: 589,336

- Attempts to collect debt not owed: 293,505

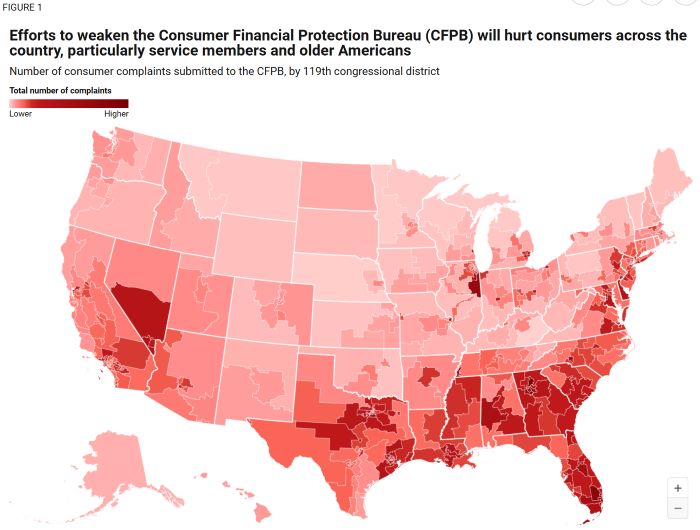

Figure 1 details how many complaints were submitted to the CFPB by congressional district from December 1, 2011, to April 7, 2025.

Conclusion

The CFPB has helped millions of consumers and delivered billions of dollars in redress for Americans. Handling consumer complaints is central to that work. Without a strong CFPB, Americans will lose money to scams and fraudsters, and financial institutions will wield inordinate power over Americans’ financial well-being.

Originally published by The Center for American Progress, 06.10.2025, republished with permission educational, for non-commercial purposes.