Gutting people’s basic needs to pay for more tax breaks for the rich.

By Colin Seeberger

Senior Adviser, Communications

The Center for American Progress

By Andrea Ducas

Vice President, Health Policy

The Center for American Progress

Last week, House Republicans released long-awaited tax and budget proposals that would provide the top 5 percent of taxpayers with about $1.5 trillion in tax breaks. This windfall for the ultrawealthy would be paid for by gutting programs that create American jobs and help Americans afford the cost of basic needs, such as health care and groceries. If enacted, the bill would amount to the largest cuts to Medicaid and the Supplemental Nutrition Assistance Program (SNAP) in history; kill jobs; and jack up the cost of living in every region of the country. It’s no wonder a new analysis by the nonpartisan Congressional Budget Office (CBO) finds that the bill reduces resources for the poorest households while increasing them for the highest earners.

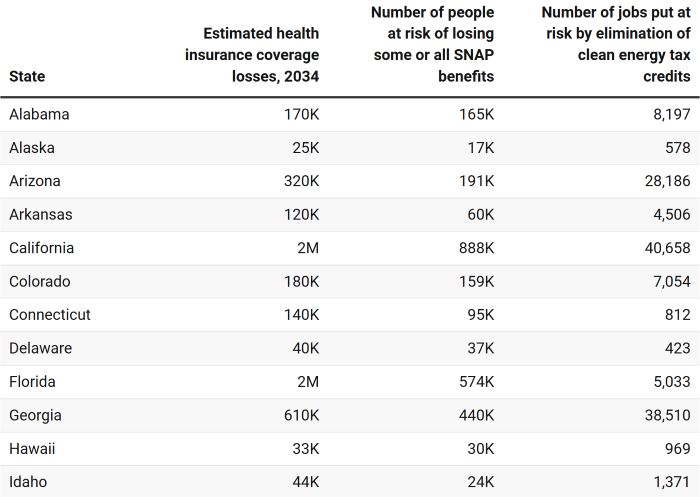

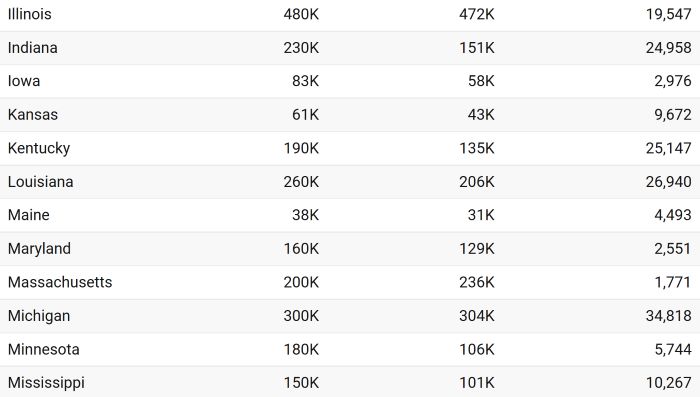

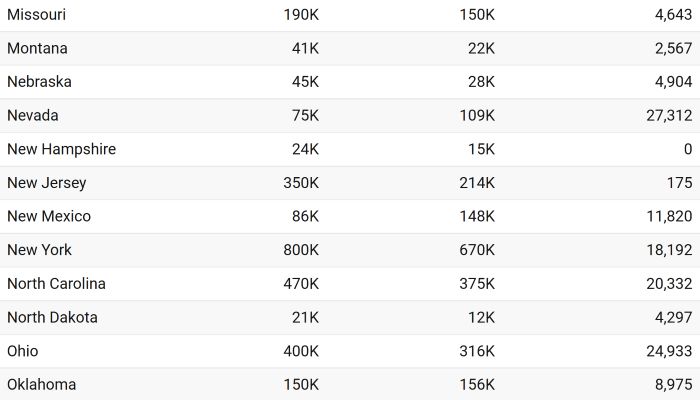

This analysis of the House budget plan includes state and congressional district-level estimates for number of people who would lose health coverage; how many Americans could see at least some—if not all—of their SNAP benefits taken away; and the number of jobs put at risk by eliminating clean energy tax credits if the bill were to become law.

Nationally, the bill—along with additional Trump administration health changes—would strip nearly 14 million Americans of health insurance coverage by 2034. The CBO estimated that 8.6 million Americans would become uninsured—primarily from losing Medicaid—because of the Energy and Commerce Committee’s portions of the bill alone. This number is preliminary and expected to grow. Another 5.1 million Americans would become uninsured because of Congress’ refusal to extend enhanced premium tax credits for the Affordable Care Act (ACA) marketplaces that help people afford their premiums as well as additional regulatory changes proposed by the Trump administration. The implications of these cuts across states are staggering: 1.8 million fewer Floridians and 1.6 million fewer Texans would have coverage by 2034. Coverage losses will exceed 100,000 people in 30 states, and 13 states will see coverage losses at or above 300,000 people.

Similarly, in the case of food assistance, nearly 11 million people could see at least some cut in benefits due to expansions to burdensome SNAP paperwork requirements included in the legislation. About 9.2 million of these people would be at risk because, for the first time, the plan applies the requirements to families with school-aged children and older Americans. An additional 1.6 million people live in areas without enough jobs and would be at risk of losing their benefits entirely from the bill’s reductions in flexibility for states to receive waivers from these requirements. Additionally, the legislation proposes shifting a portion of costs the federal government currently pays on to states, which could also jeopardize beneficiaries’ SNAP eligibility.

Finally, the House Republicans’ plan to eliminate the Inflation Reduction Act’s clean energy tax credits could put as many as 686,000 jobs (both operational and construction) at risk. Since the passage of the clean energy tax credits in August 2022, companies have invested $321 billion in the manufacturing and deployment of clean energy, clean vehicles, electrification of homes and businesses, and carbon management, leading to the creation of more than 2,300 new facilities that created over 300,000 jobs across the country. Another $522 billion and 686,000 jobs (both operational and construction) have been announced but are still outstanding and are likely to be cancelled if Congress repeals some clean energy tax credits and makes others unusable due to unworkable red tape, as proposed in the House bill.

Rather than working to make health care more accessible and affordable; grocery bills less of a burden; as well as create good-paying American jobs, the House Republican tax and budget proposals would rip away health care, food, and jobs from everyday Americans. This would inflict even more pain on working families grappling with higher prices caused by President Donald Trump’s tariffs. The American people see this proposal for what it is—a massive transfer of wealth from the working-class to the ultrawealthy—which is why Americans overwhelmingly oppose gutting people’s basic needs to pay for more tax breaks.

READ ENTIRE ARTICLE AT THE CENTER FOR AMERICAN PROGRESS