Cryptocurrency investments have come a long way since the inception of Bitcoin over a decade ago. Bitcoin, once a novel concept, has evolved into a significant digital asset that has captured the attention of both retail and institutional investors worldwide. However, as the crypto space matures, more advanced investment opportunities have emerged. In this article, we will explore these advanced crypto investment territories, offering insights and guidance for those looking to navigate this dynamic landscape.

Bitcoin’s Journey: A Brief Overview

The Birth of Bitcoin and Its Creator

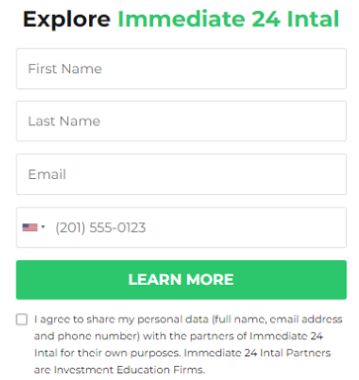

Bitcoin was created in 2009 by an individual or group operating under the pseudonym Satoshi Nakamoto. It aimed to provide a decentralized, peer-to-peer digital currency that could bypass traditional financial intermediaries. Click the image below to learn about investing and get started with the investment education journey.

Bitcoin’s Rise to Prominence

Over the years, Bitcoin gained recognition and acceptance, evolving from a niche experiment to a global phenomenon. Key moments in Bitcoin’s journey include its first recorded transaction, the introduction of Bitcoin exchanges, and its increasing adoption as a store of value, with Bitcoin brokers in the UK playing a significant role in facilitating access for investors.

Key Milestones and Developments

Notable milestones include the Bitcoin halving events, which reduce the rate at which new Bitcoins are created, and the integration of Bitcoin into traditional financial systems through products like Bitcoin futures and ETFs.

Beyond HODLing: Advanced Crypto Investment Strategies

Understanding HODLing vs. Active Trading

HODLing, the strategy of holding onto your cryptocurrency assets for the long term, has been a popular approach. However, active trading involves buying and selling cryptocurrencies to profit from price fluctuations.

Diversification: The Power of a Crypto Portfolio

Diversifying your crypto investments across different assets can mitigate risk. Consider allocating funds to a mix of cryptocurrencies, including both established and emerging ones.

Yield Farming and Liquidity Provision

DeFi platforms offer opportunities for users to earn passive income by providing liquidity to liquidity pools and participating in yield farming.

Staking: Earning Rewards with Proof of Stake Coins

Staking involves holding and locking up certain cryptocurrencies in a network’s wallet to support its operations. In return, stakers earn rewards in the form of additional coins.

Navigating Crypto Exchanges and Wallets

Choosing the Right Crypto Exchange

Selecting a reputable exchange is crucial. Factors to consider include security measures, trading fees, available assets, and user-friendliness.

The Importance of Secure Crypto Wallets

To safeguard your crypto assets, use secure wallets. Hardware wallets, in particular, are considered highly secure because they store your private keys offline.

Cold vs. Hot Wallets: Pros and Cons

Cold wallets (offline) are more secure but less convenient for frequent transactions, while hot wallets (online) offer easier access but are more vulnerable to hacking.

DeFi and Decentralized Applications (DApps)

What Is DeFi, and How Does It Work?

DeFi, short for Decentralized Finance, is a blockchain-based financial ecosystem that aims to recreate traditional financial services without intermediaries.

Yielding Profits through DeFi Protocols

DeFi platforms offer various opportunities, such as lending, borrowing, and decentralized exchanges, allowing users to earn interest and fees.

Risks and Challenges in DeFi Investments

While DeFi can be lucrative, it is not without risks. Smart contract vulnerabilities, market volatility, and regulatory uncertainties are concerns to be aware of.

Risk Management and Security

Understanding Crypto Volatility

Cryptocurrencies are known for their price volatility. It’s essential to have a risk management strategy in place to protect your investments.

Importance of Risk Management Strategies

Risk management involves setting limits, diversifying your portfolio, and having an exit plan. It can help you avoid significant losses.

Protecting Your Crypto Investments: Best Practices

Implement strong security practices, such as using two-factor authentication, regularly updating software, and avoiding suspicious links and emails.

Taxation and Legal Considerations

The Complex World of Crypto Taxation

Crypto tax regulations vary by country and can be complex. It’s advisable to keep detailed records of your crypto transactions and consult a tax professional.

Regulatory Environment for Crypto Investments

Stay informed about the evolving regulatory landscape for cryptocurrencies in your jurisdiction to ensure compliance.

Seeking Professional Advice

Given the unique challenges of the crypto space, consulting with legal and financial professionals experienced in cryptocurrency is a wise decision.

Conclusion

As the cryptocurrency landscape continues to evolve, advanced investment opportunities emerge. To successfully navigate these territories, investors must be informed, cautious, and willing to adapt to the ever-changing market conditions. By understanding the journey of Bitcoin, exploring advanced investment strategies, prioritizing security, managing risk, and staying compliant with taxation and legal requirements, investors can cross the Bitcoin bridge and thrive in the world of advanced crypto investments.