When it comes to silver investing, few coins inspire as much confidence as the 1 oz American Silver Eagle worldwide. Dealers, investors, and collectors recognize this coin instantly and accept it without hesitation at fair market prices. The trust this coin commands didn’t happen by accident but developed through decades of consistent quality and government backing that competitors struggle to match.

Backed by the U.S. government and admired for its timeless design, it stands as a global benchmark for purity and authenticity that sets standards others follow. The eagle’s reputation extends far beyond American borders, with international markets treating these coins as premium products worth slightly more than generic silver rounds due to recognition and liquidity advantages.

Why the Silver Eagle remains the go-to choice for both seasoned investors and newcomers alike comes down to trust, beauty, and practical advantages. Understanding what makes the 1 oz American Silver Eagle special helps explain why it consistently outsells competing bullion programs despite sometimes carrying slightly higher premiums over spot silver prices than alternatives.

A Legacy of Trust: Government-Guaranteed Purity

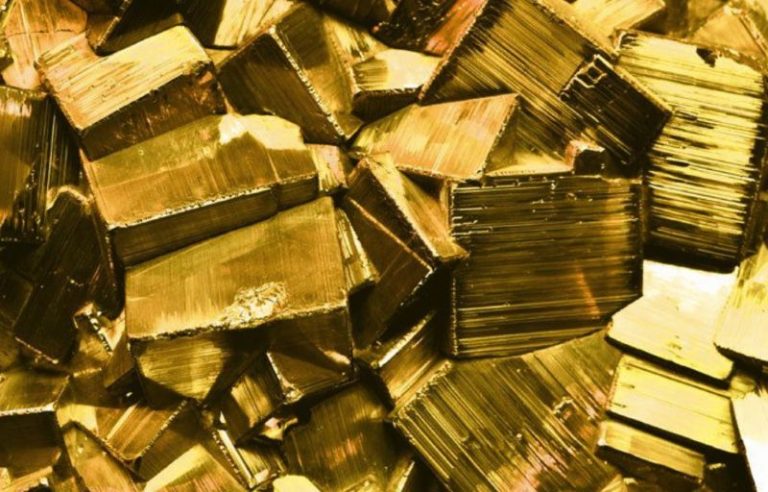

U.S. Mint backing provides guarantees that private mints and foreign programs can’t match for American investors who trust domestic government assurances. Each coin contains exactly one troy ounce of .999 fine silver, verified and stamped by the federal mint. This government certification eliminates concerns about purity or weight that generic rounds sometimes raise among cautious buyers.

Legal tender status with one-dollar face value provides additional government legitimacy even though intrinsic silver value far exceeds nominal denomination. This legal tender designation means coins are official U.S. currency under law, not just private mint products. While nobody would spend Eagles at face value, the legal status provides psychological comfort and potential advantages in certain legal or tax situations.

Authentication confidence comes from sophisticated anti-counterfeiting measures and consistent quality standards that make fakes relatively easy to spot. The U.S. Mint’s reputation and security features mean buyers can confidently verify authenticity through simple tests and visual inspection. This ease of authentication provides peace of mind that generic silver products from unknown sources cannot offer reliably.

Timeless Design and Cultural Significance

Adolph Weinman’s Walking Liberty design on the obverse represents one of America’s most beloved coin designs from the early 20th century. The graceful figure striding toward sunrise captures optimism and freedom in ways that resonate emotionally beyond just monetary value. This artistic heritage elevates Silver Eagles above purely utilitarian bullion into something collectors appreciate aesthetically.

The heraldic eagle reverse reinforces American symbolism while providing bold, recognizable imagery that makes coins instantly identifiable. Thirteen arrows, olive branch, and shield all carry historical meaning connecting modern investors to founding principles. These symbolic elements create cultural connections that generic bullion rounds completely lack despite identical silver content.

Consistent design across decades builds familiarity and trust that changing designs would undermine. Unlike some programs that alter images frequently, Silver Eagles maintain visual continuity allowing even casual observers to recognize authentic examples. This consistency supports liquidity and authentication while building brand recognition that benefits all owners through enhanced marketability and acceptance.

Liquidity and Global Recognition in Silver Markets

Universal acceptance by dealers worldwide means Silver Eagles sell quickly at fair prices without searching for specialized buyers. Walk into virtually any coin shop with Silver Eagles and you’ll get immediate offers based on current spot prices plus reasonable premiums. This liquidity advantage matters enormously when investors need to convert holdings to cash quickly without accepting steep discounts.

Premium pricing above generic silver reflects market recognition of quality, liquidity, and desirability that commands small but meaningful price advantages. While spot silver determines base value, Silver Eagles consistently trade slightly higher than generic rounds because buyers prefer recognized products. These premiums represent real value for the recognition and ease of resale that Eagles provide.

International markets treat American Silver Eagles as premium products accepted readily across borders. European and Asian dealers recognize Eagles and buy them confidently, providing liquidity even when traveling or relocating internationally. This global acceptance matters for investors who value flexibility and want holdings that maintain value regardless of geographic location.

Why Collectors Value the Silver Eagle’s Consistency

Annual mintages create collectible value beyond silver content for dates with lower production numbers or special circumstances. While common dates trade near bullion prices, key dates command premiums from collectors seeking complete sets. This dual nature means Eagles serve both investment and collecting purposes depending on specific dates and conditions.

Proof and special editions offer collectors enhanced versions with mirror finishes, special packaging, and limited mintages appealing to numismatists. These premium products command substantial prices above bullion Eagles while sharing the same basic design and government backing. The range from basic bullion to high-end proofs provides options for different budgets and collecting philosophies.

Graded examples in top conditions achieve significant premiums from collectors seeking perfect specimens. Professional grading services encapsulate and certify Eagles, with MS70 or PF70 examples trading far above raw coin values. This grading market adds another dimension where Silver Eagles shine through consistent quality allowing many examples to achieve top grades that enhance value substantially.

Conclusion

The enduring trust and reputation behind the 1 oz American Silver Eagle stems from government backing, beautiful design, universal recognition, and proven reliability over decades. Highlighting its reliability as both an investment and collectible shows why experienced investors consistently choose Eagles despite alternatives that sometimes offer lower premiums.

The combination of factors working together creates value exceeding simple silver content. Government guarantee, aesthetic appeal, global liquidity, and collecting potential all justify the slight premium Silver Eagles carry over generic alternatives. For investors prioritizing trust, ease of resale, and recognition, American Silver Eagles remain the gold standard of silver bullion despite the ironic terminology.