Payments are all about seeking simpler methods of trading. It began with basic bartering and, gradually, with time, people discovered how to transfer value in a more efficient manner. Every step in that process addressed a problem that the previous system was unable to, and that is how we got to where we are today. When you consider blockchain, you can observe how it is simply the logical extension of all that preceded it.

Blockchain and the New Digital Frontier

The latest trend in the way we pay is blockchain, but it is not like the previous one. It does not need a bank or third party to ensure that everything is legit, as was the case with old systems. The transactions are checked on distributed ledgers, which remain locked after confirmation. That is why blockchain is causing ripples in such areas as fintech, retail, and even iGaming. If you read the review by Viola D’Elia on payment methods in online casinos, you can see how platforms are leveraging crypto to provide things like faster payouts, big game libraries, and bonuses that are much easier with digital currencies. Bitcoin was the first to start in 2009, and since that time, blockchain projects have been multiplying. Others are constructed to be fast, others to be scalable, and many are constructed to be industry-specific.

Blockchain’s not just about money either. It is being applied in supply chains, healthcare, and logistics to ensure records are secure. Also, using smart contracts, transactions are automatically executed when some conditions are fulfilled. The difference between blockchain and other systems is that it does not depend on one authority. The transactions can be checked by anyone. It is almost as though it is the logical extension of all the various payment systems that preceded it.

Contactless and Instant Transfers

Instant was the thing before blockchain. Banks constructed real-time systems that enabled money to flow nearly instantly. In 2008, the Faster Payments network was introduced in the UK, and then other nations followed. The SEPA Instant in Europe ensured that transfers in euros occurred within seconds, and destinations such as Singapore and India transformed payments by demanding real-time transfers. People desired things to be quicker, and the benchmark was established.

Contactless payments went off around that period. NFC technology allows individuals to tap their phones or cards rather than swipe them. It was faster, safer, and simpler. Customers enjoyed it, businesses had shorter queues, and everybody was happy. Yet despite all that speed, cross-border payments were still too long. It is at this point that blockchain began to appear as the next solution.

Online Payments and Digital Wallets

The internet brought payments to a new level. An example is PayPal, which allows individuals to make payments online without providing bank information. It was safe for buyers and it was safe for sellers as they could reach a global audience. Subsequently, digital wallets such as Apple Pay, Google Pay, and Samsung Pay moved payments to phones. They kept coded information and frequently relied on fingerprint or face recognition, which made it all faster and more secure.

Such wallets also simplified the process of handling such things as recurring payments and minor transactions. Alipay and WeChat Pay went a step further in China by incorporating payments into social applications. Individuals were able to shop, pay bills, and send money without leaving the app, and payments became another aspect of the daily routine, not a task. It was an entirely new rethinking of the flow of money.

Credit Cards and Electronic Networks

The credit cards were a revolution. The first card was introduced by Diners Club in 1950, and Visa and Mastercard soon took it worldwide. The introduction of credit cards brought about the concept of buy now, pay later, and this altered the way people shop. They have also, over the years, included other features such as rewards programs, fraud protection, and insurance, which have made them even more appealing.

Meanwhile, banks began to develop electronic systems to provide people with more convenient access to their money. In the 1960s, ATMs became a common occurrence, and individuals could withdraw cash whenever they wanted. Fast payment networks were also constructed by banks, and this facilitated business transactions. Travel was also made easier by credit cards, as you did not need to carry foreign currency. Cards and networks combined to make the entire financial system easier.

Checks and Promissory Notes

Checks and promissory notes were the order of the day before credit cards. These enabled individuals to carry money without carrying coins. Checks became a common business and personal finance tool by the 18th and 19th centuries. Promissory notes assisted traders in borrowing or lending credit, which assisted in the development of small businesses.

This paper-based system was the basis of modern banking. People could rely on written promises instead of carrying around heavy coins. It simplified trade and increased business opportunities.

Paper Banknotes

Another giant leap was paper money. It was originally used in China in the Tang Dynasty to address the issue of carrying coins. It was common in China by the 13th century and later spread to Europe. European banks began to issue notes secured by gold or silver in the 17th century, and this was used to control inflation and the economy.

Paper notes were not valuable in themselves, but they represented value. This allowed governments to control their economies, finance wars, and develop infrastructure in a manner that they could not with coins alone. Paper money simplified trade on a large scale and became a commodity of international trade.

Coins

Coins were in use before paper money. The earliest coins were Lydian coins of the 7th century BCE, of electrum. Coins were small, portable, and could be divided easily, and this was a great improvement to bartering.

Coins were used to unite the economies of empires such as Greece and Rome, to standardize taxes, and demonstrate their strength. Coins were not only useful but also a means of expressing power, commonly bearing the faces or symbols of rulers. Trade was based on coins for centuries.

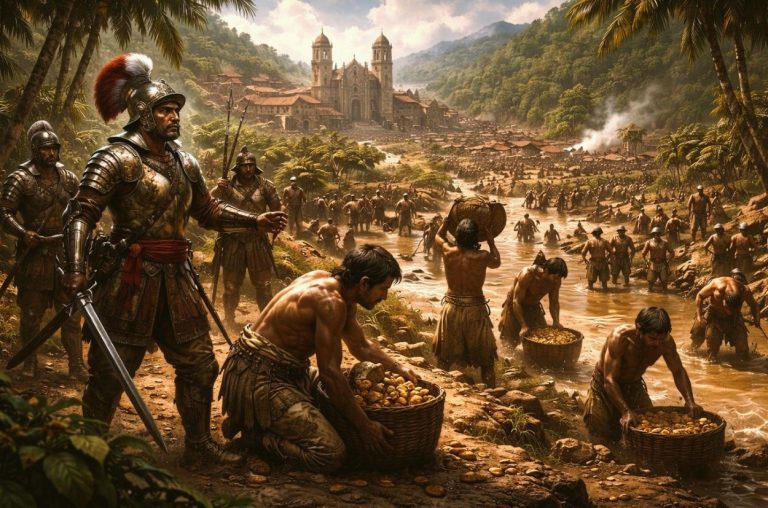

Barter and Early Trade

Initially, all was barter. People exchanged what they possessed with what they required, be it livestock with tools or grain with cloth. The only problem was that one had to desire what the other had simultaneously. Barter was only done on a small scale and could not be applied to large economies. It demonstrated how exchange could be effective but emphasized the necessity of a standard of value. That is when coins, paper money, and, later, systems such as blockchain entered the picture.