By Dr. Erika Vause

Assistant Professor of History

St. John’s University

This article, The Art of Making Debts: Accounting for an Obsession in 19th-Century France, was originally published in The Public Domain Review under a Creative Commons Attribution-ShareAlike 3.0. If you wish to reuse it please see: https://publicdomainreview.org/legal/

Erika Vause explores a forgotten financial history: the pervasive humor that once accompanied the literature and visual culture of debt.

“Tell me what you borrow, and I’ll tell you who you are…”1

Physiologie de l’argent par un débiteur

“The art of making debts and not paying them back”, wrote French humorist Emile Marco de Saint-Hilaire, “is one of the bases of the social order”.2 This opening aphorism served as the guiding argument for Saint-Hilaire’s 1827 L’Art de payer ses dettes et de satisfaire ses créanciers sans débourser un sou [The art of paying debts and satisfying creditors without spending a dime]. Presented as the deathbed advice of a crafty aristocratic uncle who had survived the tumults of the 1789 Revolution while elegantly dodging his debts, Saint-Hilaire’s book preached the virtues of perennial indebtedness for individuals and nation-states alike. “The more debts one has”, Saint-Hilaire explained, “the more credit. The more creditors, the more resources”.3 Unfortunately, many creditors remained stubbornly unenlightened about the benefits of never receiving their money back. Hence, in his book, Saint-Hilaire encouraged debtors to mobilize an arsenal of techniques and tricks, ranging from mastery of disguise to an exacting knowledge of every legal loophole, to ensure the credit economy continued to function as it should.

Saint-Hilaire was not alone in his debt-shirking evangelism. The “art of making debts”, as Saint-Hilaire and others referred to it, spawned an entire genre of tongue-in-cheek how-to guides and occupied a central place in the whimsical illustrations of awkward encounters between creditors and debtors sketched by some of the era’s most famous artists. Even in our finance-obsessed present, it is difficult to understand just how fascinating, and how occasionally hilarious, nineteenth-century French society seemed to find debt. The most familiar reflection of this absorption lies in the era’s literature. In the novels of Balzac, Flaubert, and Dumas, debt served as a central plot device, and one almost inevitably associated with tragedy: it revealed secret appetites, ruined ancient families, and subjected the virtuous poor to the depredations of usurers. Yet the art of making debts, embodied in works like Saint-Hilaire’s, treated the relationship between creditors and debtors not as innately devastating but rather as a cat-and-mouse game at once humorous and deeply revealing of the contradictory nature of the democratic and industrial revolutions.

At the dawn of the nineteenth century, France was a country held together by chains of credit and debt that bound workers to employers and producers to consumers. Peasants strained under hefty mortgages. Merchants relied on promissory notes and bills of exchange to buy and sell. Aristocrats ran up bills with their tailors and booters. Workers hocked their meager possessions at municipal pawnshops. Thousands of people were incarcerated each year when they couldn’t pay up, held at the private request of their creditors. Thousands more filed for bankruptcy before the nation’s commercial courts, undergoing a process fraught with social and legal dishonor.

Historians of credit have argued that its logic was not entirely, or even primarily, financial. Laurence Fontaine, for instance, has described early modern credit as a “moral economy”, meaning that it relied on highly personal judgements of character.4 Relations of credit were relations of power. In French eighteenth-century aristocratic culture, as historian Clare Crowston has argued, credit operated according to an “economy of regard” in which the very word “credit” more frequently referred to status or reputation than it did to a monetary transaction.5 This meaning did not disappear with the dawn of the nineteenth century. By the middle of the century, Marx and Engels would famously describe capitalism in The Communist Manifesto as having “pitilessly torn asunder the motley feudal ties that bound man to his ‘natural superiors’”, to leave “no other nexus between man and man than naked self-interest, than callous ‘cash payment’”.6 Yet, on the cusp of finance capitalism’s transformation into a complex system of almost staggering abstraction, debt and credit were vividly personal, and the reduction of relationships to monetary exchange was something still quite tangible.

The French Revolution of 1789 had represented a seismic shift in understandings of wealth. In what historian Rafe Blaufarb has termed “the Great Demarcation”, the revolutionaries had carved out of the incredibly complicated patchwork of feudal traditions of ownership a more or less coherent understanding of liberal private property based on notions of possessive individualism.7 Napoleon’s 1804 Civil Code placed the inalienable right to private property at the foundation of French society. Under such rigid notions of property, those who owed — rather than owned — could easily be regarded as criminals. Indeed, not only were Napoleonic laws infamously punitive to debtors, but popular prints like the much-reproduced “Crédit est mort – les mauvais payeurs l’ont tué” (Credit is dead – the bad payers killed him) testify to this attitude. In the various versions of this image that circulated across the eighteenth and nineteenth century, the murdered body of Credit, the “good fellow”, lies surrounded by an artist, musician, and soldiers armed with swords. In the background, an industrious knife-grinder toils away, unaffected by Credit’s demise because he, unlike these foppish debtors, paid with his hard-earned cash.

This insistence on contractual agreements and punctuality in paying debts did not mean that the “economy of regard” had vanished. Moreover, the tumultuous events of the French Revolution itself — which had included the confiscation of land from aristocrats and the Catholic Church, protracted war, a disastrous experiment with paper money that spiraled into inflation, and national bankruptcy — had revealed the fragile bases of private fortunes. Simultaneously instructed in the virtues of a new socioeconomic paradigm and presented with dramatic evidence of its arbitrary and even absurd character, French people eagerly sought guidance, and perhaps also comic relief.

The “art of making debts” grew out of attempts to make the new post-revolutionary financial world more legible. In early nineteenth-century French cities, an emerging culture of print and press democratized aristocratic savoir-faire and produced guides for navigating a newly mobile social order. Panoramic literature, including “tableaux” and “physiologies”, offered readers accessible knowledge of the various urban “types” with which the public could navigate a bewildering new world where traditional wisdom might be of little help. Saint-Hilaire’s book, as well as Jacques-Gilbert Ymbert’s L’art de faire des dettes and L’art de promener ses créanciers (The art of making debts and The art of giving creditors the run-around), Maurice Alhoy’s Physiologie du débiteur et du créancier (Physiology of the debtor and creditor) and the anonymously-written Physiologie de l’argent par un débiteur (Physiology of money by a debtor) provided humorous guides to the people, places, and practices of the post-Revolutionary financial system. Authors and illustrators also illuminated a country torn between an older aristocratic culture of extravagance, where the payment of debts to one’s social inferiors was considered at best unimportant and at worst taboo, and a new bourgeois society based on contractual obligation and legal equality.

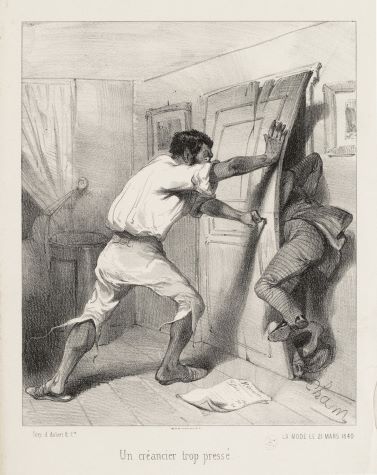

Fundamental to this “art of making debts” was mastery of the “promenade” or “run around”. As Jacques-Gilbert Ymbert explained in his 1824 L’art de promener ses créanciers, “the goal of the promenade is to bore the creditor, to bring him to such a state of fatigue and annoyance that, out of breath, spent, and under pressure, he at last despairs of his repayment and renounces the pursuit”.8 The full run-around often took years, and the process entailed careful preparation on the part of debtors. They were encouraged to rent top-floor apartments with windows facing the street (“a creditor who has breached five flights of stairs arrives at your door tired, out of breath: it’s not money he needs, it’s a chair”) and to furnish their living quarters with strange and eccentric devices, preferably new technologies, that would divert the attention of a visiting creditor away from financial matters.9 More drastically, the manuals proposed changes of physical appearance. Recommendations included wigs, beards, fake noses, various forms of disfigurement, extreme weight gain and weight loss, even diseases.

Patience was the true secret to a successful “promenade”. Ymbert drew up a helpful table, for debtors to memorize “like the Pythagorean theorem”, that provided a scientific estimate of how long a promenade would have to be (in years and in distance) to satisfy a given creditor, as well as how many pairs of shoes a creditor would wear out in the process.10

Writers cautioned debtors to avoid chance encounters with their creditors at all costs. As Ymbert explained, the result of meeting a creditor in the street could be catastrophic:

It erases the effects of six months of promenade and gives the debt all the freshness that it had lost . . . Naked, exposed to the reproaches of your creditor . . . you stutter, you make promises. Your creditor’s strength grows from your weakness, and he is reborn, throwing himself at you with all the energy he had lost.11

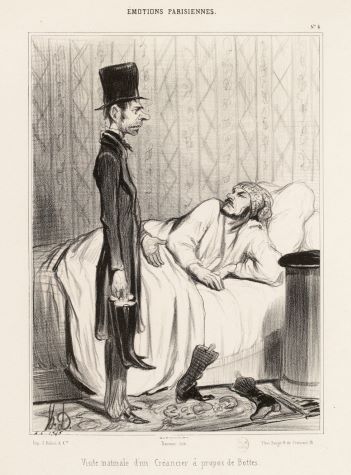

Illustrators, meanwhile, seized on such meetings as fodder for their sketches. Whether on the street, in a house, or seated alongside each other on the omnibus, interactions between debtors and creditors were apparently deemed hilarious. Honoré Daumier drew several iterations of a “creditor’s visit” where a shabby creditor approaches a half-awake young man in luxurious pajamas demanding his money.

Meanwhile, Frédéric Bouchot’s 1842 series “Les Débiteurs et les Créanciers” portrayed interactions between twelve different creditors and their debtors, each labeled with the profession of the creditor, from clockmaker and furniture merchant to jeweler and innkeeper. In “le tapissier” (the upholsterer), the creditor kicks down a debtor’s door. In another, “le bottier” (the bootmaker), an elegant but only half-dressed young man fights over a shoe with a much shabbier-looking bootmaker.

The French public must have delighted in depictions of these awkward and all-too-familiar encounters, but these satires resonated more deeply as well, reflecting a keen awareness of the absurdities of wealth and inequality. Debtors’ manuals were avowedly designed not for the “general population who makes debts left and right”, but rather for the “proper gentleman” (an homme comme il faut).12 In L’art de faire des dettes, Ymbert described this figure as a dispossessed aristocrat. As victims of the nation’s turbulent decades, they were entitled to a certain standard of luxury as their birthright. “You were brought up to occupy a certain position in society”, Ymbert assured his readers, “unforeseeable circumstances have knocked you out of it. But your parents still invested a lot in you to prepare you for the state of a proper gentlemen . . . your person remains your capital”. Such pesky problems as utter insolvency should not keep a gentleman from the lifestyle that “society and civilization owe [him]”.13

Ymbert’s attitude towards the gentleman-debtor is not straightforward. On one hand, there is obvious mockery of his entitled air. Ymbert was writing shortly before the restored Bourbon government finally granted monetary indemnities to émigré nobles for their confiscated lands, following years of aristocratic complaints. Yet the ruined aristocrat also reflected a nearly universal predicament. As Saint-Hilaire rhetorically asked in a discordant moment of sincerity:

Who, has been so fortunate that after thirty years, after assignats, mandats [both forms of paper money that ended in massive inflation] and after the bankruptcy of the State . . . after emigrations, confiscations, requisitions, arrests, and invasions which have reversed every fortune, to always have been able to say ‘I owe nothing’? And which people, sitting on a pile of gold today, could say, ‘We will never be debtors?’14

The homme comme il faut, in other words, could be anyone.

Justifying the gentlemanly birthright to generate debts, however, required offering an alternative definition of property which, according to Ymbert, had “until now been very badly defined in our laws”.15 Instead of resting on land or currency, property derived principally from the individual himself. Every gentleman possessed, by birth and breeding, an innate capital constituted by his refined person, and which the world justly had to acknowledge and compensate. In certain respects, this understanding of Ymbert’s insistence on the superiority of cultural and social status over alienable properties belongs to an old-fashioned economy of regard.

Yet, juxtaposed with the persistence of this intangible economy of prestige and appearance, the manuals attempted to attach an exact monetary value to specific, allegedly interchangeable “assets”. Ymbert assessed the worth of “thirty-two very white teeth” at 1600 francs and a “calf six inches in diameter” at 2400 francs.16 A gentleman’s total worth, independent of any money or land, amounted to some two hundred thousand francs, on which society owed him interest. The humor of Ymbert’s approach lay in his attempt to commodify the crucial but immeasurable traits upon which lending depended. It is here that Ymbert and other writers reveal the full complexity of their satire. Not merely do they poke fun at fashionable dandies seeking to prolong aristocratic culture into a bourgeois age, but these authors also use these figures to demonstrate the absurdity of emergent financial capitalism.

Other iterations of this “balance sheet” took this critique even further. Maurice Alhoy’s Physiologie du créancier et débiteur provided the following calculation of the worth of a debtor by the time he reached his early 20s:

My mother carries me for nine months in her womb, during this time she has expensive tastes, and, in assessing them at the lowest I can evaluate at … 3000 francs

I enter the world: the expenses of childbirth, care, baptism, etc etc … 500 francs

The wetnurse for two years, including the cost of soap, sugar and first teeth … 2500 francs

For 6 years I grow up and develop in my father’s house: I am spoiled, it’s not too much to put my caprices at 500 fr a year . Thus … 3000 francs

I am put in a boarding school; I stay 8 years. The university house costs 1200 francs per year … 9600 francs

The so-called “polishing” teachers come… for 1,500 a year. All for nothing: … 9000 francs

I go to law school: the price of my registration, the purchase of indispensable books, the living expenses that my age and social position demand, 2400 francs per year, for three years: … 7200 francs

Total of my capital: … 34,800 francs17

Yet, despite the immense monetary investment into the young debtor, he would find to his shock that his “man capital, or capital-man” entitled him to nothing in the eyes of lenders and bankers. “It does not inspire the least amount of trust in him and nobody will lend to him on the basis of its value”. Faced with such manifest injustice, the humorist wryly noted, what choice did the proper gentleman have but to rely on the art of making debts to get by?

A parody of early political economy accompanied this heterodox interpretation of property. Paraphrasing economist Jean-Baptiste Say, Ymbert maintained that any modern society was comprised of two fundamentally opposed classes: “producers” and “consumers”. Rather than being at war, however, these classes were inextricably interlinked through debt — “producers”, as Saint-Hilaire explained it, “are none other than creditors; consumers are none other than debtors”.18 Since each relied on the other to survive, paying off one’s creditor severed ties between them and thereby “paralyzed the economy”. As proof of their economic analyses, the manuals presented comparisons between personal debt and national debt. “The grandeur of a nation is always in proportion to its deficit”, opined Saint-Hilaire, “so you should reason by analogy”.19 The most prominent example of this maxim was Great Britain, France’s inveterate enemy, whose long-pursued victory over Napoleon was largely attributed to its use of a Sinking Fund. Ymbert even included a chapter in which prime minister William Pitt the Younger, the Fund’s architect, learns the “art of making debts” from a Swiss banker named Schneider, who pays off his creditors with wisdom on his deathbed. If never-ending deficits worked for the world’s most powerful country, why shouldn’t they work for you?

The economy of debt-making was nevertheless a circumscribed one. As Ymbert stated, “Running up debts to those who don’t have enough is to increase disorder and multiple misfortune. On the other hand, running up debts with those who have too much is to make up for misfortunes and reach towards reestablishing the equilibrium”.20 Debtors were encouraged to consistently patronize the finest jewelers, tailors, cobblers, and restaurants. Not only was the quality of their goods superior, Ymbert claimed, but in taking from those “who already had” one helped “restore equilibrium” between those who had “too much” and those who had “not enough”. Above all, however, at such places the fashionable gentleman would in fact reimburse his debt several times over by inspiring others, through his example, to pay for the products that he himself consumed on credit. He would “tie his cravat like an angel and thus push our muslin industry to its highest degree”.21 And, taking breakfast at a café, he would make it fashionable by his very presence, inspiring a desire to spend money on exotic delicacies by “eating with contagious grace”. The debtor was, in short, an early nineteenth-century influencer who would use his charisma to increase consumption and satisfy his debts without “spending a dime”.

What happened to the art of making debts? Even at the beginning of the nineteenth century, parodists believed it to be a vanishing craft. In 1827, Saint-Hilaire noted that his deceased uncle’s wisdom about dodging creditors was quickly fading into obsolescence. “Every day in Paris”, he remarked, “it becomes harder to make a revenue from one’s debts as one did before: the merchants are less gullible, the workers less patient, the usurers less numerous, relatives, mistresses and friends are less generous and the courts more severe”.22

Yet, in another sense, the art of making debts is timelier than ever. We live today in a world where our creditors are largely faceless and impersonal forces of capital rather than people we can bump into on the street, yet the humor still resonates. After all, it is easy enough to transpose the early nineteenth-century homme comme il faut, “unjustly” deprived of the social position to which he felt entitled by revolutionary upheaval, onto the caricature of the overeducated, underemployed twenty- or thirty-something of today, burdened by student loan debt yet unable to find a job befitting their unique talents. Criticized for frittering away their savings on avocado toast and dreaming of YouTube stardom, the millennial and Gen Z predicament instead reveals many of the same discrepancies between ideologies of responsibility and property and the realities of credit so adeptly satirized by the art of making debts. At a time when states and multinational companies alike seem to take on tremendous debt without suffering the consequences, yet ordinary citizens find themselves unable to emerge from under the weight of bills, credit remains as mysterious and omnipotent as it was in post-revolutionary France.

Appendix

Endnotes

- Anonymous, Physiologie de l’argent par un débiteur (Paris: Desloges, 1841), 20.

- Emile Marco de Saint-Hilaire, L’Art de payer ses dettes et de satisfaire ses créanciers sans débourser un sou, enseigné en dix leçons, ou Manuel de droit commercial par feu mon oncle (Paris: Imprimerie de Balzac, 1827), 6.

- Saint-Hilaire, L’art de payer ses dettes, 33.

- Laurence Fontaine, The Moral Economy: Poverty, Credit, and Trust in Early Modern Europe (Cambridge: Cambridge University Press, 2014).

- Clare Haru Crowston, Credit, Fashion, Sex: Economies of Regard in Old Regime France (Durham, NC: Duke University Press, 2013).

- Karl Marx and Friedrich Engels, The Communist Manifesto, https://gutenberg.org/cache/epub/61/pg61.html. Accessed April 26, 2021.

- Rafe Blaufarb, The Great Demarcation: The French Revolution and the Invention of Modern Property (Oxford: Oxford University Press, 2016).

- Jacques-Gilbert Ymbert, L’art de faire des dettes, suivi de l’art de promener ses créanciers; par un homme comme il faut, 3rd ed. (Brussels: Arnold Lacrosse, 1825), 98.

- Ymbert, L’art de faire des dettes, 117-18.

- Ymbert, L’art de faire des dettes, 112.

- Ymbert, L’art de faire des dettes, 133-134.

- Ymbert, L’art de faire des dettes, VII.

- Ymbert, L’art de faire des dettes, 198.

- Saint-Hilaire, L’art de payer ses dettes, 35.

- Ymbert, L’art de faire des dettes, 5.

- Ymbert, L’art de faire des dettes, 8.

- Maurice Alhoy, Physiologie du créancier et du débiteur (Paris: Lavigne, 1842), 3.

- Saint-Hilaire, L’art de payer ses dettes, 36.

- Saint-Hilaire, L’art de payer ses dettes, 36.

- Ymbert, L’art de faire des dettes, X.

- Ymbert, L’art de faire des dettes, XII.

- Saint-Hilaire, L’art de payer ses dettes, 146.

Public Domain Works

- Physiologie de l’argent par un débiteur (Anonymous, 1841), Bibliothèque Nationale de France

- L’Art de payer ses dettes (Emile Marco de Saint-Hilaire, 1827), Bibliothèque Nationale de France

- L’art de faire des dettes (Jacques-Gilbert Ymbert, 1825), Google Books

- Physiologie du créancier et du débiteur (Maurice Alhoy, 1827), Bibliothèque Nationale de France

Further Reading

- The Great Demarcation: The French Revolution and the Invention of Modern Property, by Rafe Blaufarb

- Credit, Fashion, Sex: Economies of Regard in Old Regime France, by Clare Haru Crowston

- In the Red and in the Black: Debt, Dishonor, and the Law in France between Revolutions, by Erika Vause