It will cost distilled spirit importers over $1 billion in lost trade.

By Dr. Andrew Muhammad

Professor of Agriculture and Resource Economics

University of Tennessee

Introduction

If all the tariff drama in the news lately has you reaching for a stiff drink, you’re not alone. Unfortunately, those same tariffs might make it harder to get your hands on your favorite brand of tequila.

In early March 2025, U.S. President Donald Trump levied import tariffs of 25% on goods from Canada and Mexico, following through on a promise he made back in November 2024. While he later partially reversed course, suspending tariffs on some goods, tensions remain high. Mexico is largely holding off on retaliation, but Canada quickly fired back with counter-tariffs on billions of dollars’ worth of U.S. products.

These trade tensions spell trouble for numerous industries, including the booming spirits market. Canada and Mexico – two of the top U.S. trading partners – accounted for nearly half of the US$12 billion in distilled spirits the U.S. imported in 2024.

As an agricultural economist, I’ve analyzed how a 25% tariff could affect tequila, whiskey and other distilled spirits – and the results weren’t pretty. I found that these tariffs would cost distilled spirit importers over $1 billion in lost trade, with tequila alone taking a more than $800 million hit.

America’s Thirst for Imported Liquor

The U.S. imports far more distilled spirits than it exports – five times as much by value, as of 2024.

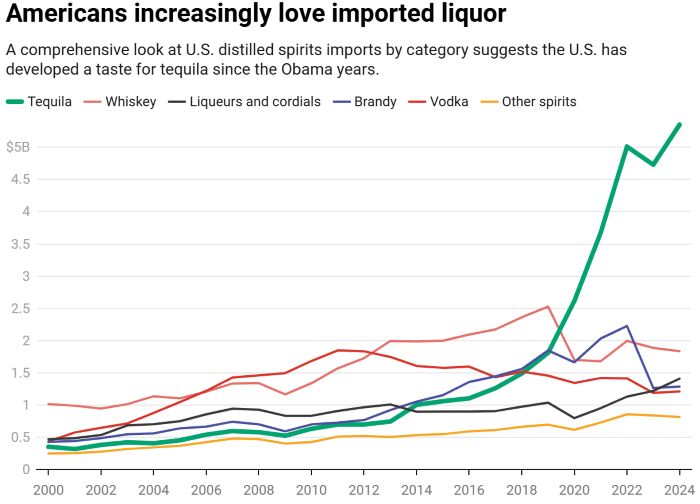

Since 2000, U.S. imports of distilled spirits have surged by more than 300%, driven largely by the explosive rise in tequila consumption. Between 2000 and 2024, tequila imports rose by 1,400%, skyrocketing from $350 million to $5.4 billion.

While imports of whiskey, liqueurs, vodka and brandy also grew, none matched tequila’s explosive rise. Tequila now represents 45% of all spirits imported into the U.S., up from 12% in 2000.

Not surprisingly, 99% of tequila and mezcal is imported from Mexico, making it the leading foreign supplier of distilled spirits to the United States. Meanwhile, Canada has supplied between 4% and 6% of U.S. spirits imports over the past two decades, primarily whiskey and liqueurs.

Since distilled spirits are classified as agricultural products, their rising imports have significantly contributed to the U.S. agricultural trade deficit. However, this isn’t necessarily a problem. Imports help meet demand from U.S. consumers, generate value-added opportunities for U.S. companies, and support economic activity in bars, liquor stores, restaurants and beyond.

A 25% Tariff on Mexican Goods Is a 25% Tax on Tequila

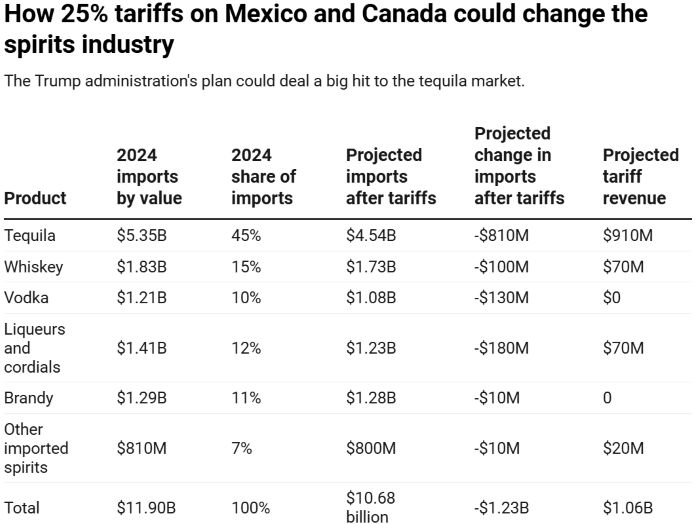

In my study, published in February in the peer-reviewed journal Agribusiness and in a follow-up policy brief, I found that 25% tariffs on Mexico and Canada could reduce imports of distilled spirits by $1.2 billion. This loss exceeds the total amount of tax revenue those tariffs can expected to bring in.

Unsurprisingly, tequila imports would be the hardest hit, falling by $810 million. I found that the tariff revenue from tequila – $910 million – could actually exceed the corresponding fall in imports. That’s because demand for tequila, like most alcoholic beverages, is what economists call “inelastic,” meaning that when prices rise, consumers are unlikely to change their purchasing decisions by very much.

However, it would be a mistake to consider tequila in isolation. When I factored in other notable decreases, such as a $100 million drop in whiskey imports, I found that the value of total trade losses, in the form of decreased imports, would outweigh the total tariff revenue. I also found that no product category would come out ahead.

In fact, even products like vodka, which are mostly exempt from these tariffs, would be indirectly affected. This is because tariffs can increase the overall cost of importing, leading businesses to reduce all imports, tariffed or otherwise. My research suggests that this “trade destruction” effect, to use an economics term, will be quite significant.

A New Era of Tariffs

The Trump administration has argued that tariffs will generate a lot of money for the federal government. But my research suggests those gains may not outweigh the economic costs to businesses and consumers.

Contrary to common belief, trade losses don’t just affect exporting countries. Domestic consumers also face higher prices and fewer choices – hurting their overall economic welfare. Reducing imports also affects U.S. businesses involved in marketing, distribution and sales.

Trade is more complex than a simple formula of “exports good, imports bad.” Research makes it clear that tariffs have negative consequences, including higher consumer prices, reduced product availability and downstream economic disruption. Policymakers would be wise to take those effects seriously. Otherwise, they might find themselves with a serious economic hangover.

Originally published by The Conversation, 03.26.2025, under the terms of a Creative Commons Attribution/No derivatives license.