The concept of banking has existed in some form or another since settled civilizations began. Once successful people gained lots of currency, they sought ways to safely store it.

Checking, however, is a slightly more complicated banking concept. In the 1500s, expensive Asian goods hit the European market. Wealthy people needed a way to regularly and safely pay Dutch traders. The concept of writing a note and depositing money emerged.

There is an interesting background to the history of checking — check it out below.

Defining Checking

Even in the 1500s, a check was essentially a written order for someone to be paid from the check writer’s funds. In the past, physical people, known as “cashiers,” held the physical funds.

Now, we trust huge institutions to hold our earnings digitally in checking accounts, and we have more documentation like a check stub. Despite these changes, there appears to be just as mistrust in these institutions as there was in cashiers back in the 1500s.

The History of Checking in Holland

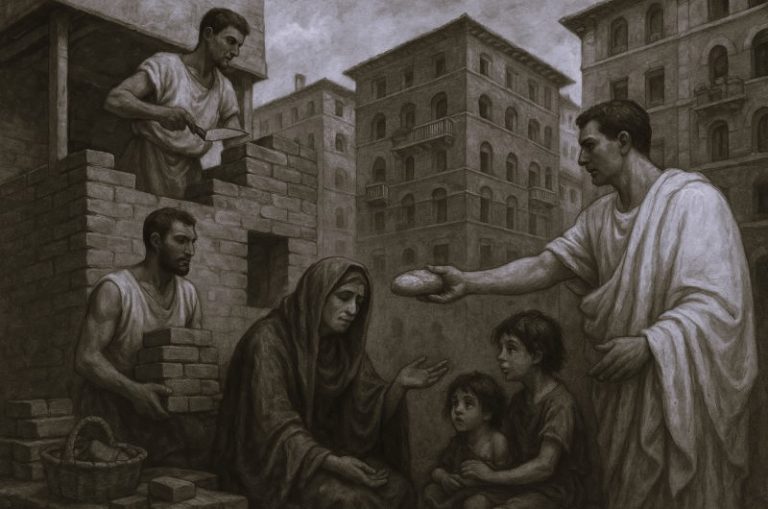

Although there is some evidence of checking in India, the Roman Empire, and Persia, the practice began to spread out of 1500s Holland. Amsterdam was a huge international trading center where expensive Asian spices and other products flooded the market. Traders and merchants needed a place to store their new wealth and decided to keep it with local Dutch cashiers.

As the merchants are busy traveling around the world, they eventually allowed the cashiers to pay their debts through written authorizations.

Checking in England

The practice of depositing money and writing authorizations for others to use that money began to spread throughout Europe, particularly in England. However, like all new ideas, it was not immediately accepted.

The British were wary of leaving their life savings with a virtual stranger. Nonetheless, the practice was useful enough to still be around in 1700s Britain, when they began crafting “bills of exchange” for domestic payments.

Checking in the United States

As checking was developing in Europe, it was also forming in the United States. In the 1600s, it was not uncommon to write out an IOU and later pay it.

In 1681, the practice of checking became more formal in Boston. A group of businessmen created a sort of primitive bank called The Fund. People would sell goods to the fund and receive credits in their Fund account, then write checks to buy and sell things with those credits.

This became such frequent practice that other Funds started popping up until an entire system of Funds existed throughout the country. This obviously had a huge influence on the history of banking today.

More Business History

Knowing business does not just mean familiarizing yourself with current trends, but knowing past ones. The history of checking is not only fascinating but necessary information for someone in the banking industry. History helps professionals in any field better understand the conceptual significance of their work.

For more business-related guides and advice, make sure to stop by our business section.